seventy seven% Whilst a wonderful credit score score may get you an average automobile loan rate of five.twenty five%. A less-than-suitable credit history rating could make it tough to qualify using a lender, but you will discover undesirable credit motor vehicle loans with lower credit score requirements.

Doc Costs—That is a charge gathered with the supplier for processing documents like title and registration.

Have an Energetic email tackle and use of a computer or cellular system to finalize your software on the internet.

Typically, rebates are only made available For brand new cars. Although some employed auto dealers do give money rebates, This really is uncommon as a result of the difficulty involved in pinpointing the legitimate value of the vehicle.

gov, such as submitting their PSLF kind and monitoring their development toward forgiveness. These updates will simplify the method for borrowers and allow for quicker processing of PSLF forms. These enhancements are actually in the is effective for because day one of several Administration as Component of the Office’s initiatives to overhaul loan servicing and implement significant advancements to all of its loan forgiveness plans, which include PSLF.

We will offer you a look for the proceeds of one's loan when you evaluation and indication your documentation at among our many Business places.

· $fifty one billion for greater than 1 million borrowers through administrative adjustments to income-pushed repayment payment counts. These changes have brought borrowers closer to forgiveness and resolved longstanding concerns Together with the misuse of forbearance by loan servicers.

Fork out Unique consideration to the every month payment, complete desire charges and interest price or APR when comparing individual loans.

We acquire satisfaction in offering the finest doable customer support to our purchasers. At Tower Loan, we pay close awareness to your requirements making sure that the process of getting credit is as simple as doable.

You can also make and 69 loan print a loan amortization schedule to view how your regular monthly payment will pay-from the loan principal furthermore desire above the program in the loan.

Although the allure of a fresh car or truck could be sturdy, buying a pre-owned automobile regardless of whether only a few several years faraway from new can typically bring about major discounts; new cars and trucks depreciate as soon as They can be driven off the lot, occasionally by a lot more than 10% in their values; this is referred to as off-the-ton depreciation, which is an alternative selection for possible vehicle prospective buyers to consider.

To secure a very good baseline of your respective APR, we’ll get started with the average amount for an car loan dependant on particular credit rating rating ranges. Vehicle buyers with an outstanding credit rating ranging from 780 to 850 were being capable of get new vehicle loans for a median rate of 2.

Amortized loans tend to be a lot more difficult. The First payments for amortized loans are usually desire-major, which means that extra of the payments are likely toward interest than the principal loan balance.

Automobile loans guideBest vehicle loans forever and undesirable creditBest car loans refinance loansBest lease buyout loans

Luke Perry Then & Now!

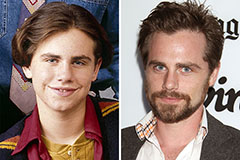

Luke Perry Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!